The collaboration is one of the first General Insurance and Digital Banking partnerships of its kind in Vietnam. Together Chubb and Techcombank will co-create innovative insurance solutions and products for Techcombank’s 10.8 million customers, under its digital general insurance business, TechCare. Leveraging on the superior underwriting expertise and distribution capabilities of Chubb, TechCare will offer a convenient way for consumers in Vietnam to get protection tailored for their lifestyle needs.

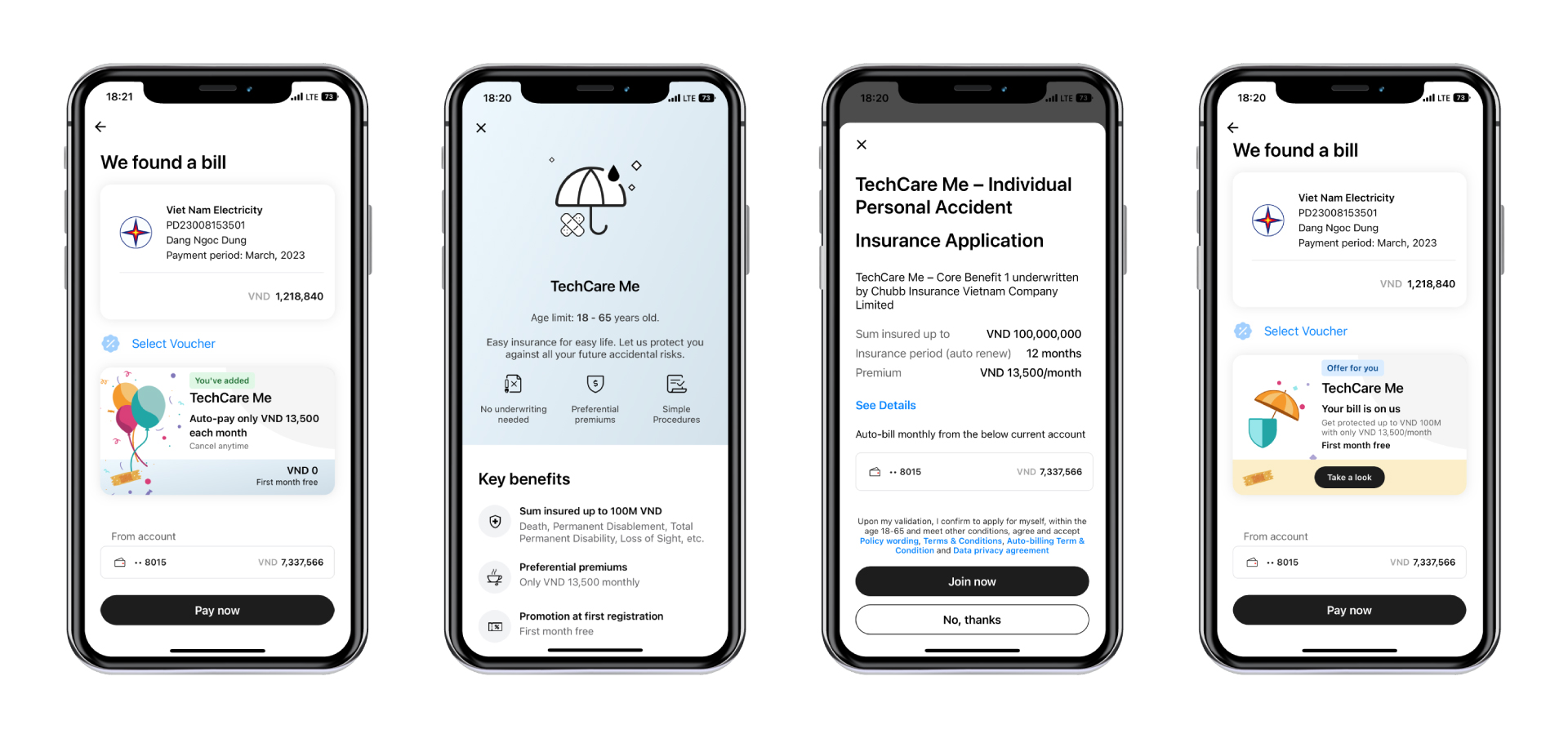

TechCare Me is the first product launched under the new collaboration. It is a unique accidental product for Techcombank’s Inspire customers – young and digitally-savvy Vietnamese – as an in-path offering during their payment journey on Techcombank Mobile.

TechCare Me will be available to Inspire customers through Techcombank Mobile, one of the first in Vietnam that insurance payments have been integrated into a mobile banking app. The entire customer journey will be digitalized and the customer interactive experience fully personalized.

The partnership with Chubb reaffirms Techcombank’s position as a leader in the digital transformation of the banking industry in Vietnam and furthers its vision to Change banking, Change lives.

Darren Buckley, Chief Retail Banking Officer of Techcombank, said: “We are very excited to be partnering with Chubb in developing and offering embedded, innovative general insurance products within the Techcombank Mobile Banking App. It is not only aligned with our strategy to source market leading solutions that meet the needs of our growing base of retail customers, but also to help make insurance more accessible and convenient, lowering the barriers to access affordable financial protection for people in Vietnam.”

Edward Ler, Chubb’s Head of Southeast Asia, shared “As one of the fastest growth countries in Southeast Asia, Vietnam’s population is largely made up of young, smart and hardworking individuals and the country is also home to a large middle class. Techcombank is well-positioned to offer insurance protection to these consumers who are also digitally-savvy. We are really excited to partner with Techcombank to embed TechCare Me in their customers’ bill payment journey as a start. By continuing to leverage our strengths in product innovation and digital distribution, we are looking forward to helping Techcombank enrich their digital offerings and stay a step ahead of their customers' needs.”

“Techcombank has been leading digital transformation in the banking industry in Vietnam. As we continue on the journey to becoming a next-generation bank, we are pleased to work with partners like Chubb who are aligned with our digital strategy, and able to co-create and deliver customer-centric propositions.” Pranav Seth Chief Digital Officer of Techcombank

Khue Dinh, Country President of Chubb’s general insurance business in Vietnam said: “Bancassurance partnerships are very effective in making insurance accessible and affordable for consumers in Vietnam, many of whom have very thin layer of protection against unexpected risks like accidents. While the consumers have the means to fulfil their lifestyle needs, seeking insurance protection may not be their priority. Chubb is known for building a simplified in-path and tailored insurance experience through embedded insurance. The partnership also represents our contribution to raise awareness of the value of insurance protection so that consumers can continue to live their dreams.”

Underwritten by Chubb as a value-added protection feature when paying their bills via Techcombank Mobile, TechCare Me provides coverage for accidental death and permanent total disablement on a subscription basis.

From 09/03, customers who sign up online for TechCare Me will receive complimentary coverage on the first month.

Additional products will be co-created under the partnership to offer digital banking users protection for their online transactions such as money transfers, travel bookings and more.

ABOUT TECHCOMBANK

Vietnam Technological and Commercial Joint Stock Bank (Techcombank) is one of the largest joint stock banks in Vietnam, and a leading bank in Asia, with a vision to Change Banking, Change Lives. The Bank pursues a proven customer-centric strategy in providing a broad range of retail, SME and business banking solutions and services to help financially empower its customers. Techcombank has over 10.4 million retail and corporate customers, which it serves through a market-leading digital banking platform and mobile app, and an extensive network of transaction service outlets at locations across Vietnam. The Bank’s ecosystem approach, co-created through partnerships in multiple key economic sectors, adds further scale and differentiation in one of the fastest growing markets in the world.

Techcombank is the only bank in Vietnam rated with Ba2 (“Stable” Outlook) for Baseline Credit Assessment (BCA) by Moody’s. The Bank is also rated by S&P with BB – “Stable” Outlook. Techcombank is listed on the Ho Chi Minh Stock Exchange (HoSE) as TCB.

Recognized for excellence and innovation, Techcombank received the following awards in 2022:

- “Best Bank in Vietnam” – Euromoney in 2022 (awarded for 3rd year);

- “Domestic Retail Bank of the Year – Vietnam”, and “Credit Card Initiative of the Year – Vietnam” – Asian Banking & Finance in 2022 (ABF);

- “Best Digital Consumer Bank” – Global Finance in 2022;

- “Best Companies to work for in Asia” – HR Asia in 2022;

- “Leading Partner Bank in Vietnam” 3Q22 – Asia Development Bank (the third year in a row).

ABOUT CHUBB

Chubb is the world’s largest publicly traded property and casualty insurer. Chubb has both general insurance and life insurance operations in Vietnam. Its general insurance operation in Vietnam (Chubb Insurance Vietnam Company Limited) offers specialized and customized coverages for Property, Casualty, Marine, Financial Lines, Energy & Utilities, as well as Accident & Health. The company focuses on building strong relationships with clients by offering responsive service, developing innovative products and providing market leadership built on financial strength.

More information can be found at www.chubb.com/vn.

Thông tin báo chí, vui lòng liên hệ:

DƯƠNG THỊ THANH HÀ - Bộ phận truyền thông đối ngoại

Email: hadtt22@techcombank.com.vn

Petrina Ong

Regional Head of Marcoms, Accident & Health

Email: Petrina.ong@chubb.com